Table of Content

One of the perks of homeownership — and there are plenty — is the opportunity to build equity. With every mortgage payment you make, you’ll steadily accumulate equity in your home, which can be used in a variety of ways. Pay bills, cover the costs of home renovations, fund your next big vacation — you name it. It can be tempting to overspend with a line of credit since it is easy to access funds. This can lead to debt problems and financial troubles if not handled properly.

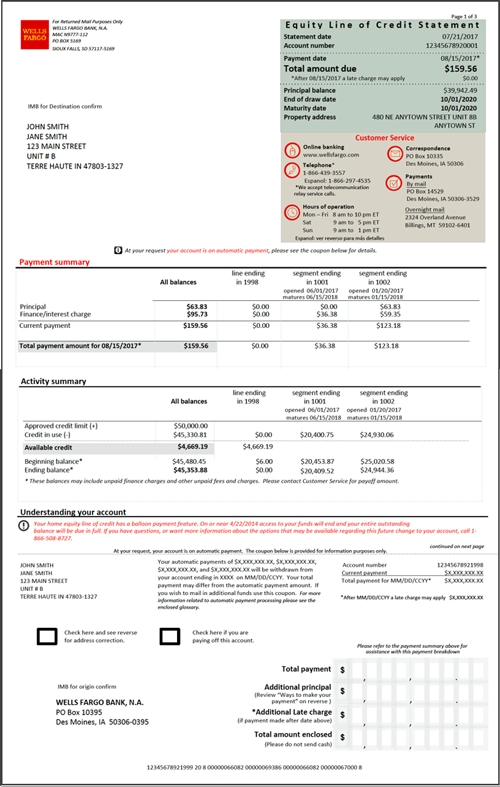

Once approved, the lender sets interest, repayments, and other terms for the line of credit. Then, to provide access to the funds, some lines of credit may allow the borrower to write checks, while others include a type of credit card. The terms of every HELOC vary but they most commonly have a draw period of 10 years and a repayment period of around 15 years. During the draw period, borrowers have the option to use up to their credit line limit on their HELOC and make minimal interest-only payments.

What causes HELOC rates to change?

Be sure to compare interest rates and APRs, and dig into the guidelines around rate changes, including the timing and the maximum possible increase . The repayment terms are fully open, meaning that you can repay up to 100% of the loan in a lump sum payment anytime. The monthly payments generally consist of interest only, and the interest rate varies with the prime rate. As you withdraw money from your HELOC, you’ll receive monthly bills with minimum payments that include principal and interest.

Once they receive the loan amount, they have to start repaying a portion of the principal amount with interest immediately, even if they have not used the funds yet. A loan is typically a lump sum whereas a line of credit is typically revolving which allows for the borrower to draw, repay, and again draw as needed. HELOCs offer attractive borrowing rates for large sums of money—up to 65% of your home’s value.

Home Equity Loans and Home Equity Lines of Credit

HELOCs typically offer lowerclosing costs compared with other types of loans. In general, the higher your credit score and lower your debt-to-income ratio, the more attractive your interest rate offers will be. This option may be good for someone who has inconsistent income or is using their Heloc proceeds to buy an investment property that won’t generate much cash for the first few years, he says. Both strategies require an appraisal to determine your property value and an evaluation of your financial profile and existing mortgage debt to calculate how much you can borrow.

If you are looking for a property insurance quote in Quebec, you will be directed to Click Insurance, where you will be able to compare quotes from top insurance companies in that province. If you are looking for a car insurance quote in Quebec, you will be directed to Lussier Insurance, where you will be able to compare quotes from top insurance companies in that province. If you are looking for a car insurance quote in Quebec, you will be directed to Click Insurance, where you will be able to compare quotes from top insurance companies in that province. Because HELOCs are secured using your home as collateral, you are at risk of losing your home to foreclosure if you can't pay yours back.

What can a HELOC help you do?

Borrowers may also get a 0.25 percent rate discount for having a TD Bank checking account. Figure promises an easy online application process with approval in five minutes and funding in as few as five business days. Figure could be a good option for borrowers who need fast cash. See competitive home equity rates from lenders that match your criteria and compare your offers side by side.

Receive funds.The time between offer acceptance and funds disbursement varies by lender, but some may make HELOC funds available in as little as one week. From there, you can use your funds as needed and begin making payments. TD Bank typically ranks high in customer satisfaction and offers low rates on its HELOCs (starting at 3.99 percent in some areas).

How do I qualify for a HELOC?

Unsecured LOC usually has higher interest rates compared to secured LOC. This is because there is a higher risk for the lender when a loan is not backed by collateral. SBLOCs is a type of line of credit that uses the assets in the borrower’s investment portfolio as collateral. With this set-up, it is as if the borrowers can access 50% to 95% of the value of their assets without having to liquidate any of their securities. A significant difference between a line of credit and a traditional loan is that the latter involves borrowing a sum of money and paying it on an installment basis within a given period. With a traditional loan, you cannot continually withdraw new money against the same loan.

If you are using a HELOC for any purpose other than home improvement (such as starting a business or consolidating high-interest debt), you cannot deduct interest under the tax law. Flagstar has flexible loan amounts that range from as little as $10,000 to as much as $500,000. Answer some questions about your home equity needs to help us find the right lenders for you.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. The Annual Percentage Rate for a HELOC is calculated based on a variety of factors, including credit score, loan-to-value, line amount, and location of the property securing the line of credit. With a home equity line from Truist, you can choose between a fixed or variable interest rate on each draw you take.

If you’re looking to tap the wealth you’ve built through homeownership, a home equity line of credit, or Heloc, can be one of the most flexible and least expensive options available. However, there are some disadvantages of using a line of credit, such as the temptation to overspend and higher interest rates on unsecured LOC. Prospective borrowers should take note of specific requirements to qualify for a line of credit. Although functionally the same as the previously mentioned types of LOC, with the demand LOC, the lender can decide to recall the amount borrowed at any time.

No comments:

Post a Comment