Table of Content

However, they come with significant risks, and borrowers should be aware of those issues before signing up for a product that erodes their ability to build wealth through the equity in their home. They most frequently are issued as credit cards or as a checkbook. Her expertise includes mortgages, credit card rewards, and personal finance. You can apply for a Bank of America HELOC using the bank’s online application. After answering the initial questions, you will be shown how to upload any required documents and how to check on the status of your loan application.

Home equity line of credit rates can vastly outperform interest rates on credit cards — we’re talking single digit vs. double digits. That may mean you’ll owe less interest over the life of the loan compared with a similar credit card balance. Be sure to ask about the loan’s structure up front, Alexander says. In some cases, you may be able to switch from a fixed to variable rate, or vice versa, during the repayment period.

Start your application online or give us a call.

To illustrate how this works, let's assume that your home is worth $500,000 and that you carry a $350,000 mortgage balance. Please note that applications, legal disclosures, documents or other material related to Guaranteed Rate products or services promoted on this page are offered in English only. The Spanish translation of this page is for convenience of our clients; however, not all pages are translated. If there is a discrepancy between the content of the translated page and the content of the same page in English, the English version will prevail. But it gives you something like a grace period to borrow as much money as you need, exactly when you need it, without the initial outlay of a home equity loan. Home equity loan, they are secured by your home, meaning you can expect a far lower interest rate than with many other types of debt.

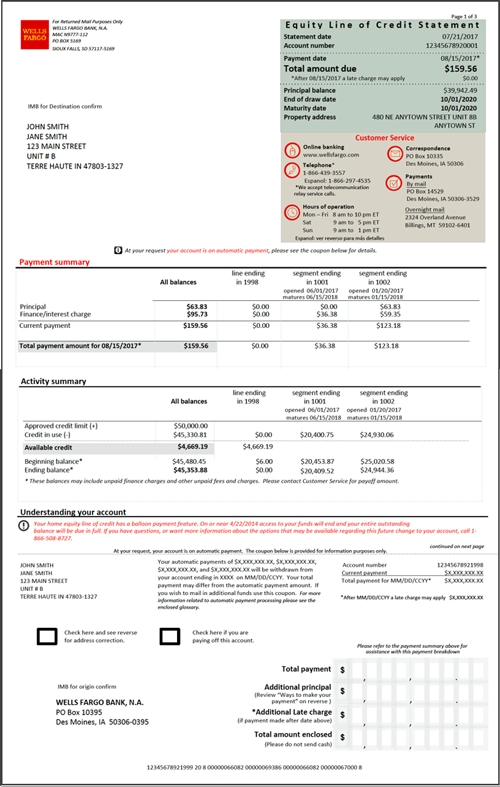

Borrower also will be required to pay for optional services (e.g., retaining an attorney not required to open a HELOC). Borrower will be required to pay for hazard insurance throughout the term of the HELOC. Borrower will not be required to pay any periodic fees to maintain the HELOC, nor any fees to obtain a variable rate or fixed rate advance during the term of the HELOC. When the HELOC terminates, Borrower will be required to pay a reconveyance fee ranging from an average of $125.00 to $235.00 but is subject to change. The main drawback to HELOCs is their variable interest rates, which mean HELOC monthly payments can be inconsistent and change with general interest rates.

Shopping for the best Heloc rates

You can cancel for any reason,but only ifyou’re using your main residence as collateral. The right to cancel doesn’t apply to a vacation or second home. Before you sign, read the loan closing papers carefully.If the loan isn’t what you expected or wanted, don’t sign.

The approval process is usually heavily influenced by the borrower’s credit rating. Thus, borrowers who have good or excellent credit have better chances of getting approved at the lowest interest rates available. In recent years, HELOC usage has risen to levels that regulators deem concerning. For example, it’s now common to approve borrowers based on them theoretically using the full amount of their HELOC limit, even though there may be no borrowing at the time of closing. There’s no downside to switching financial institutions if you find one offering mortgage and/or HELOC terms that are superior to your existing lender. However, it’s important to do the math first to ensure the move makes financial sense once you factor in fees and mortgage breakage penalties.

Compare mortgage rates:

Once the draw period is up, borrowers have to make substantially bigger payments to pay back the balance owed on the credit line they used during the draw period. Keep in mind the risks involved when using your home as collateral. If you can’t pay the money back, you could lose your home to foreclosure. Talk to an attorney, financial advisor, or someone else you trust before you make any decisions. Some dishonest lenders target older adults, homeowners with modest means, and borrowers with credit problems. They offer financing based on the equity in your home, not on your ability to repay the balance due.

Rates vary depending on creditworthiness, loan amount and other factors, APR varies by state. As with some other lenders, you can convert some or all of your balance to a fixed-rate loan. The credit union offers mortgage loans, refinance loans and HELOCs. Third Federal's HELOC offers one of the longest repayment terms of its competitors, which make payments more affordable for borrowers. Bankrate's home equity line of credit rate offers help you compare interest rates, fees, terms and more as you start your search for a loan.

She graduated from the Craig Newmark Graduate School of Journalism at CUNY and Villanova University. When not checking Twitter, Alix likes to hike, play tennis and watch her neighbors' dogs. Now based out of Los Angeles, Alix doesn't miss the New York City subway one bit.

Don’t deal with any lender who tells you not to read the financing disclosures. The law says you must get them, so make sure you do — and be sure to read and understand them before you sign for the financing. If they fill in the blanks later, you don’t know what they’ll say. How to protect your personal information and privacy, stay safe online, and help your kids do the same. One of those scams was 8 Figure Dream Lifestyle, which touted a “proven business model” and told...

Relationship-based ads and online behavioral advertising help us do that. And there's Preferred Rewards, which extends benefits to you as your qualifying Bank of America balances grow. The interest rate is often lower than other forms of credit, and the interest you pay may be tax deductible, but you should consult a tax advisor.

The Three-Day Cancellation Rule applies to many home equity loans . You’ve opened all your gifts, and now it’s time to open those post-holiday credit card statements. If you were a little too jolly with your holiday spending, here are some tips to help you pay down your credit card debt.

If you have at least 20% equity in your home, you can borrow up to 65% of your home's appraised value in the form of a home equity line of credit. Like a credit card, you qualify for an amount, then how you choose to use it is up to you - all of it, some of it, or even just a little of it. HELOCs let you transform your home equity into a revolving line of credit. This is money you’ve already invested into your home; you’re just putting it toward a different use. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

No comments:

Post a Comment